What is a Mutual Fund?

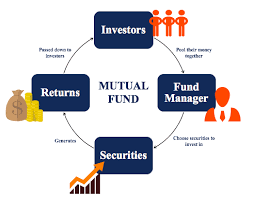

To many people, Mutual Funds can seem complicated or intimidating. We are going to try and simplify it for you at its very basic level. Essentially, the money pooled in by a large number of people (or investors) is what makes up a Mutual Fund. This fund is managed by a professional fund manager.

It is a trust that collects money from a number of investors who share a common investment objective. Then, it invests the money in equities, bonds, money market instruments and/or other securities. Each investor owns units, which represent a portion of the holdings of the fund. The income/gains generated from this collective investment is distributed proportionately amongst the investors after deducting certain expenses, by calculating a scheme’s “Net Asset Value or NAV. Simply put, a Mutual Fund is one of the most viable investment options for the common man as it offers an opportunity to invest in a diversified, professionally managed basket of securities at a relatively low cost.

It is a trust that collects money from a number of investors who share a common investment objective. Then, it invests the money in equities, bonds, money market instruments and/or other securities. Each investor owns units, which represent a portion of the holdings of the fund. The income/gains generated from this collective investment is distributed proportionately amongst the investors after deducting certain expenses, by calculating a scheme’s “Net Asset Value or NAV. Simply put, a Mutual Fund is one of the most viable investment options for the common man as it offers an opportunity to invest in a diversified, professionally managed basket of securities at a relatively low cost.

LIQUID FUND

In our lives, money lye idles for a short period of time in several cases, out of which, the exact time when the money needs to be taken out may not be known. What does the investor do? Where should the money be parked?

One must consider a few things here:

- The money is parked for a short period of time

- One would prefer that there is no drop in investment value

- Even low returns should be fine, if it means the money is safe

- The period may not be fixed or even known

Given the above four conditions, putting money in a fixed deposit may serve the purpose, but only to a limited extent. One of the big benefits of a fixed deposit is the safety. At the same time, one of the limitations is often ignored – the money can be parked for a fixed period only – there is no flexibility regarding the period of parking.

That is where liquid mutual funds could be considered. As is conveyed in the video too, they offer safety, reasonably good returns (in comparison to savings accounts or even very short-term fixed deposits) and full flexibility of redemption any time.

DEBT FUND & MIP

- A debt fund is a Mutual Fund scheme that invests in fixed income instruments, such as Corporate and Government Bonds, corporate debt securities, and money market instruments etc. that offer capital appreciation. Debt funds are also referred to as Income Funds or Bond Funds.

- A few major advantages of investing in debt funds are low cost structure, relatively stable returns, relatively high liquidity and reasonable safety.

- Debt funds are ideal for investors who aim for regular income, but are risk-averse. Debt funds are less volatile and, hence, are less risky than equity funds. If you have been saving in traditional fixed income products like Bank Deposits, and looking for steady returns with low volatility, debt Mutual Funds could be a better option, as they help you achieve your financial goals in a more tax efficient manner and therefore earn better returns.

- In terms of operation, debt funds are not entirely different from other Mutual Fund schemes. However, in terms of safety of capital, they score higher than equity Mutual Funds

HYBRID

Our choice of meals when we dine depend largely on the time at hand, the occasion and of course, our mood. If we’re in a hurry, say during an office lunch or eating before boarding a bus/train, we may opt for a combo meal. Or if we know a combo meal is famous, we may not bother to go through the menu. A leisurely meal would mean ordering individual items from the menu, as many as we’d like.

Similarly, an investor in a Mutual Fund can select and invest individually in various schemes, e.g. equity fund, debt fund, gold fund, liquid fund, etc. At the same time, there are schemes like a combo meal – known as hybrid schemes. These hybrid schemes invest in two or more asset categories so that the investor can avail the benefit of both. There are various types of hybrid funds in the Indian Mutual Fund industry. There are schemes that invest in two assets, viz., equity and debt, or debt and gold. There are also schemes that invest in equity, debt and gold. However, most of the popular hybrid schemes invest in equity and debt assets.

Different types of hybrid funds follow different asset allocation strategies. Remember to have your objectives clear before you invest.

EQUITY

Bottom of Form

An Equity Fund is a Mutual Fund Scheme that invests predominantly in shares/stocks of companies. They are also known as Growth Funds.

Equity Funds are either Active or Passive. In an Active Fund, a fund manager scans the market, conducts research on companies, examines performance and looks for the best stocks to invest. In a Passive Fund, the fund manager builds a portfolio that mirrors a popular market index, say Sensex or Nifty Fifty.

Furthermore, Equity Funds can also be divided as per Market Capitalisation, i.e. how much the capital market values an entire company’s equity. There can be Large Cap, Mid Cap, Small or Micro-Cap Funds.

Also, there can be a further classification as Diversified or Sectoral / Thematic. In the former, the scheme invests in stocks across the entire market spectrum, while in the latter it is restricted to only a particular sector or theme, say, Infotech or Infrastructure.

Thus, an equity fund essentially invests in company shares and aims to provide the benefit of professional management and diversification to ordinary investors.

ELSS

An ELSS is an Equity Linked Savings Scheme, that allows an individual or HUF a deduction from total income of up to Rs. 1.5 lacs under Sec 80C of Income Tax Act 1961.

Thus if an investor was to invest Rs. 50,000 in an ELSS, then this amount would be deducted from the total taxable income, thus reducing her tax burden.

These schemes have a lock-in period of three years from the date of units allotment. After the lock-in period is over, the units are free to be redeemed or switched. ELSS offer both growth and dividend options. Investors can also invest through Systematic Investment Plans (SIP), and investments up to ₹ 1.5 lakhs, made in a financial year are eligible for tax deduction

Our New Brands in Mutual Fund